Stop getting denied and start getting approved!

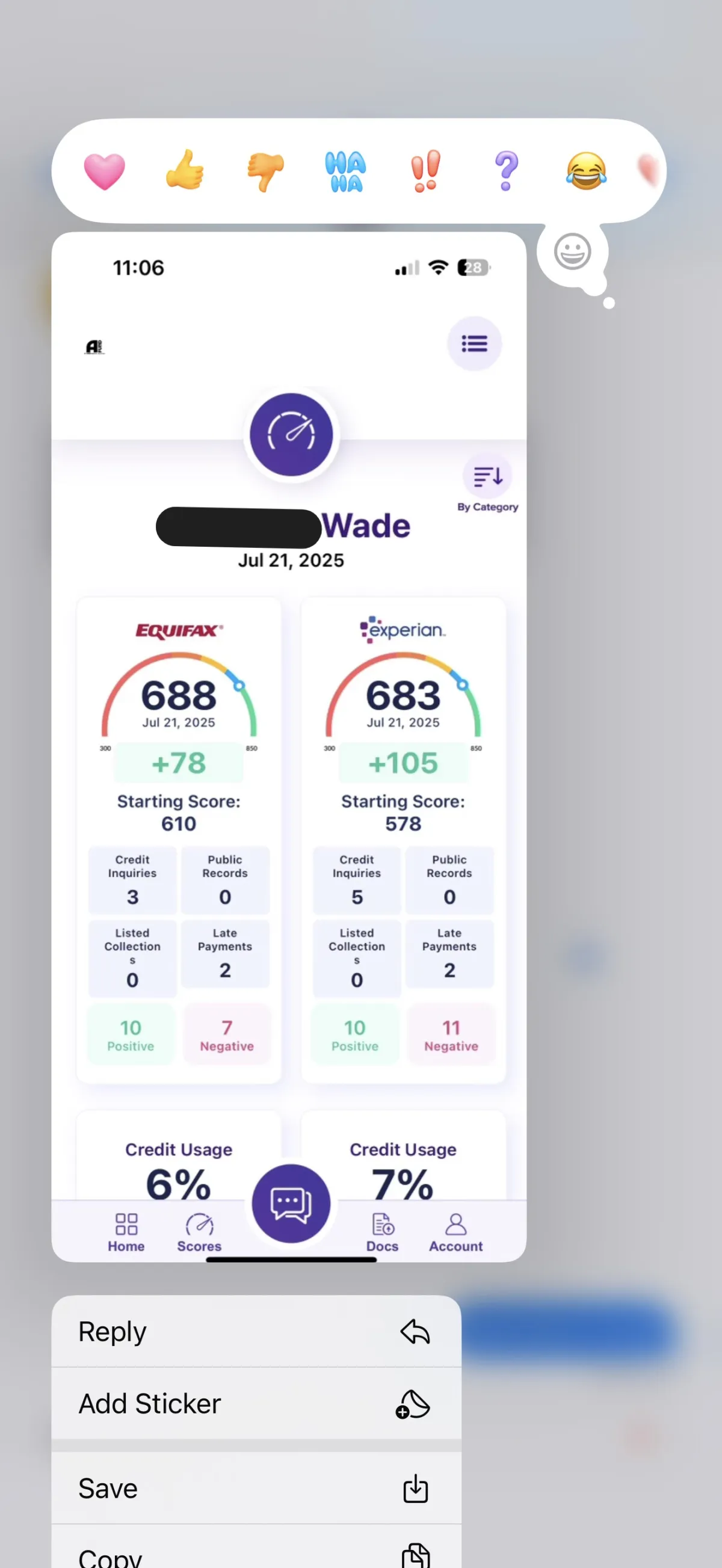

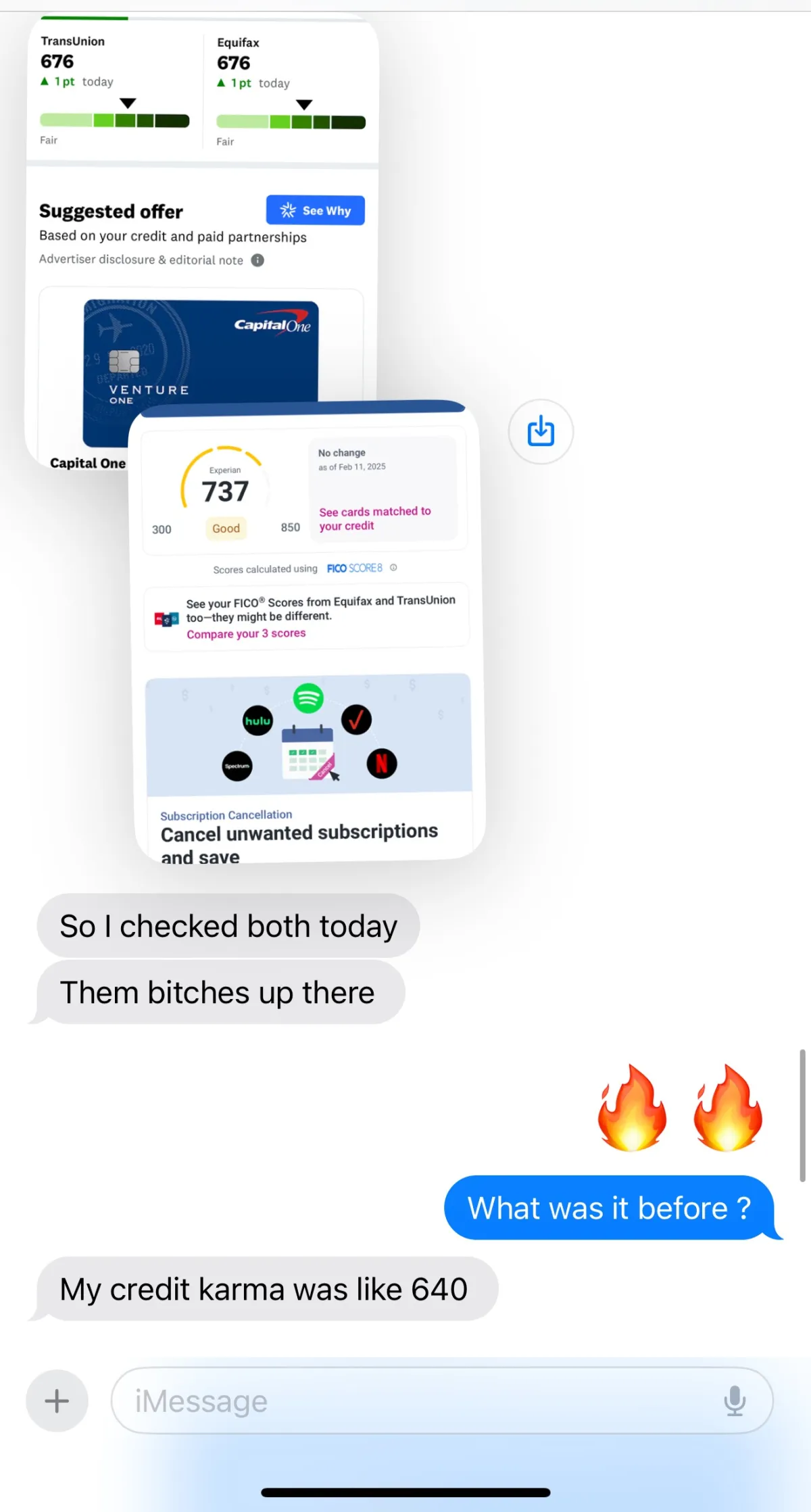

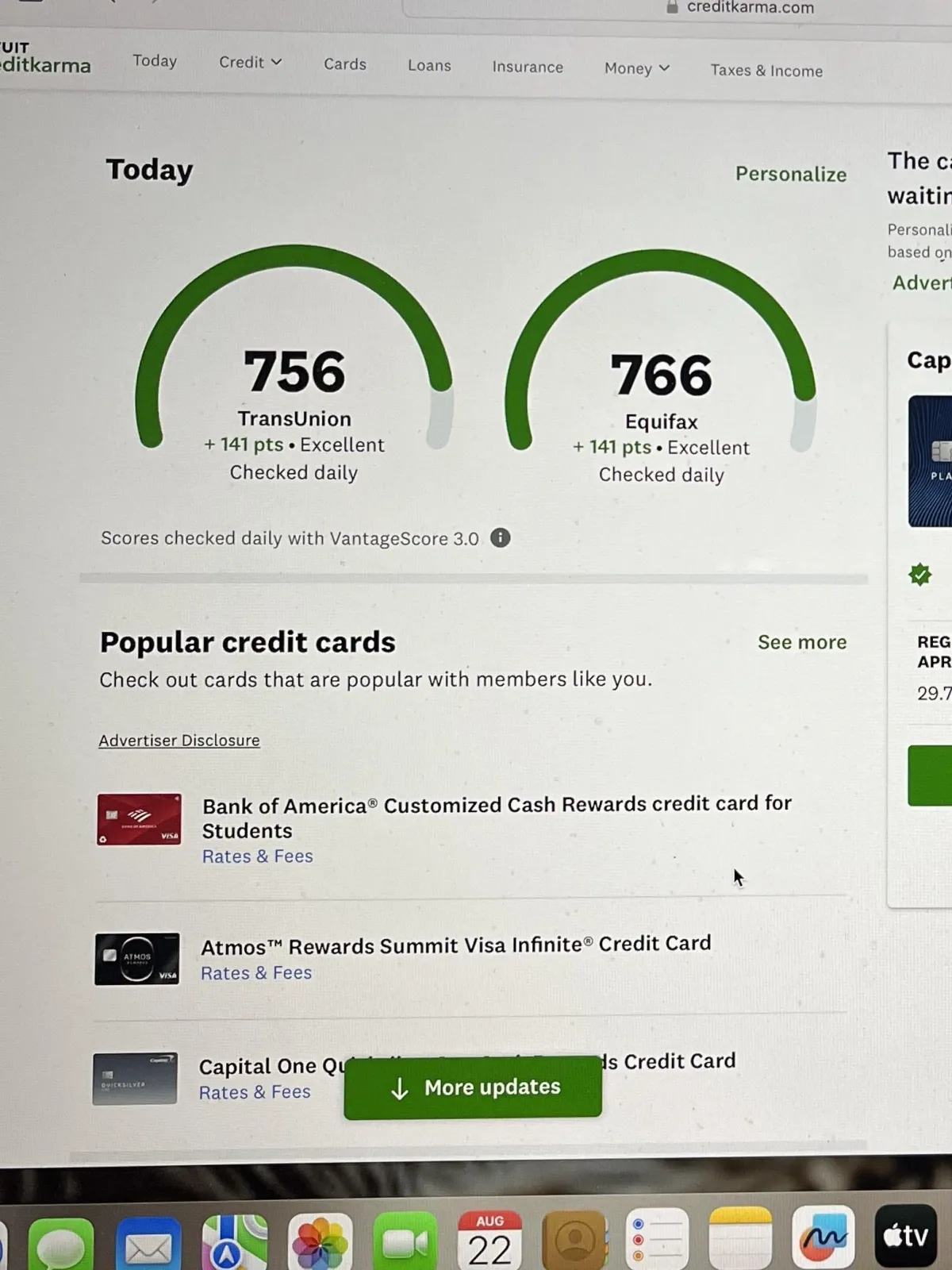

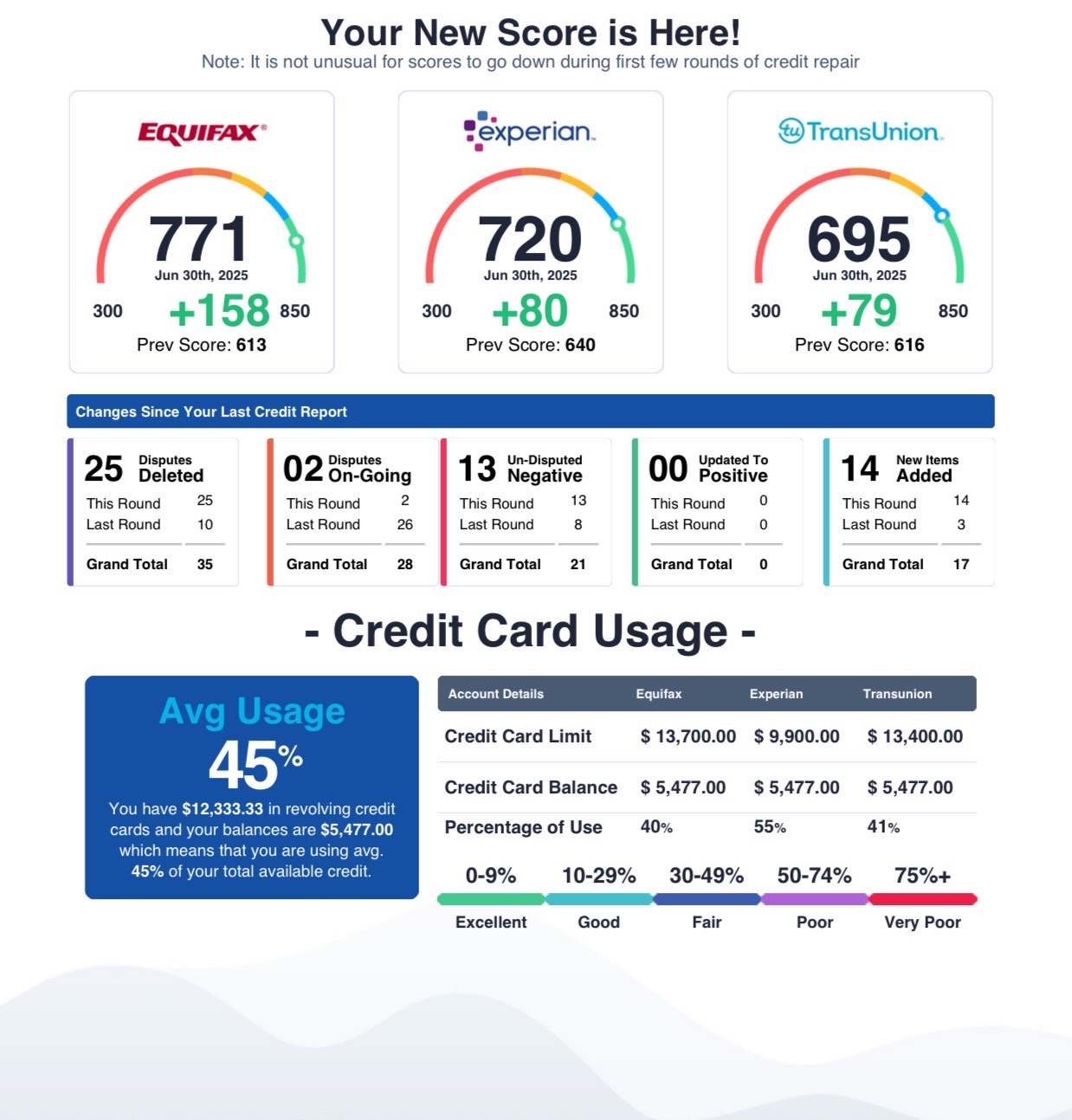

Tired of getting denied? Boost your credit to the +700's and get funding in just 30 days.

The LAST Marketing Software You’ll Ever Need

Book a 1-on-1 call Down Below for your step by step blueprint

We’ve already helped over +150 people increase their credit scores and qualify for business, auto, & home funding.

(No obligation — see if you qualify)

Before working with us

Constantly gettig denied

Getting approved for low limits

Dealing with high interest rates

Getting ripped off by expensive credit repair companies

Biz Funding blueprint

Struggling to boost your scores

After working with us

Never getting denied again

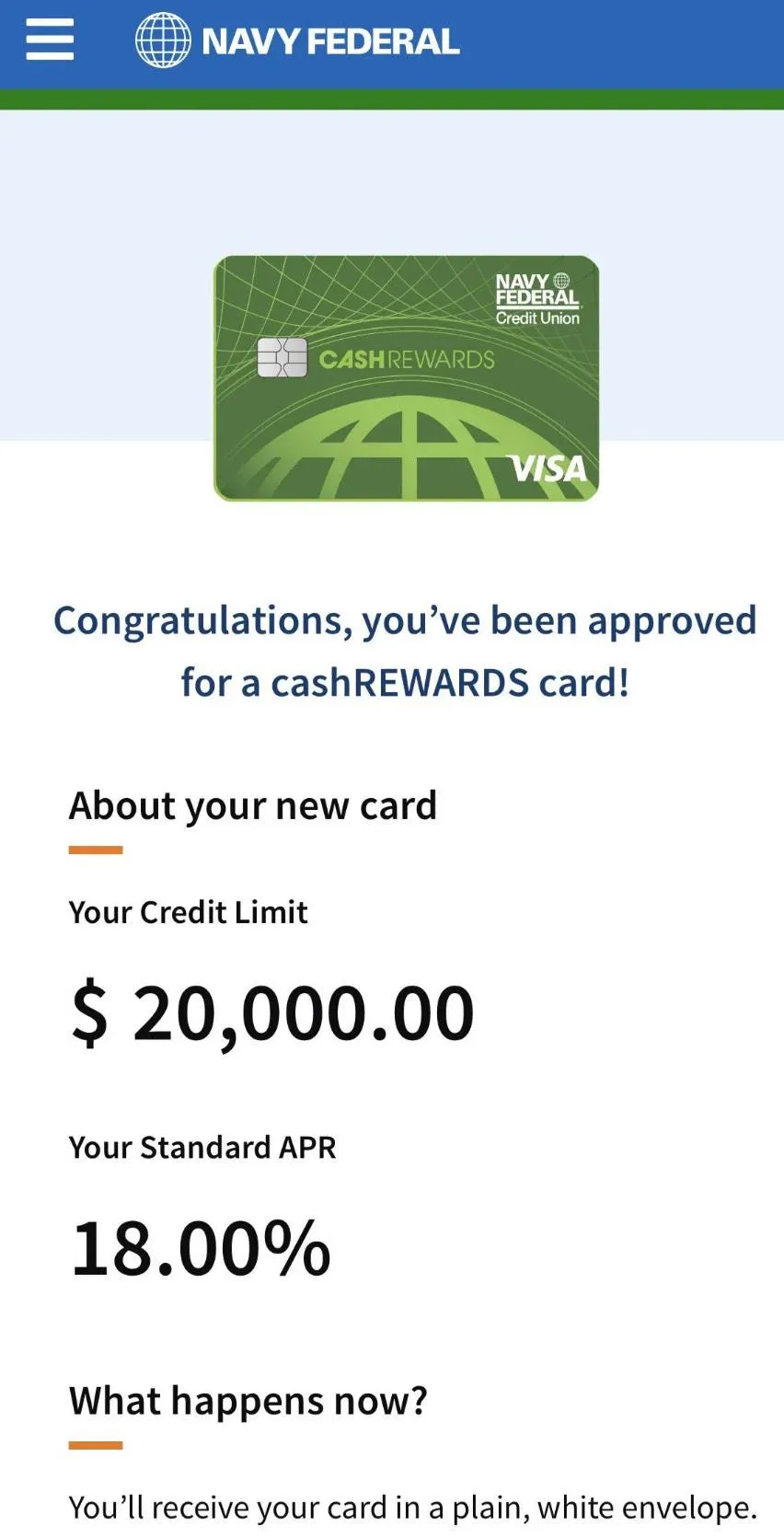

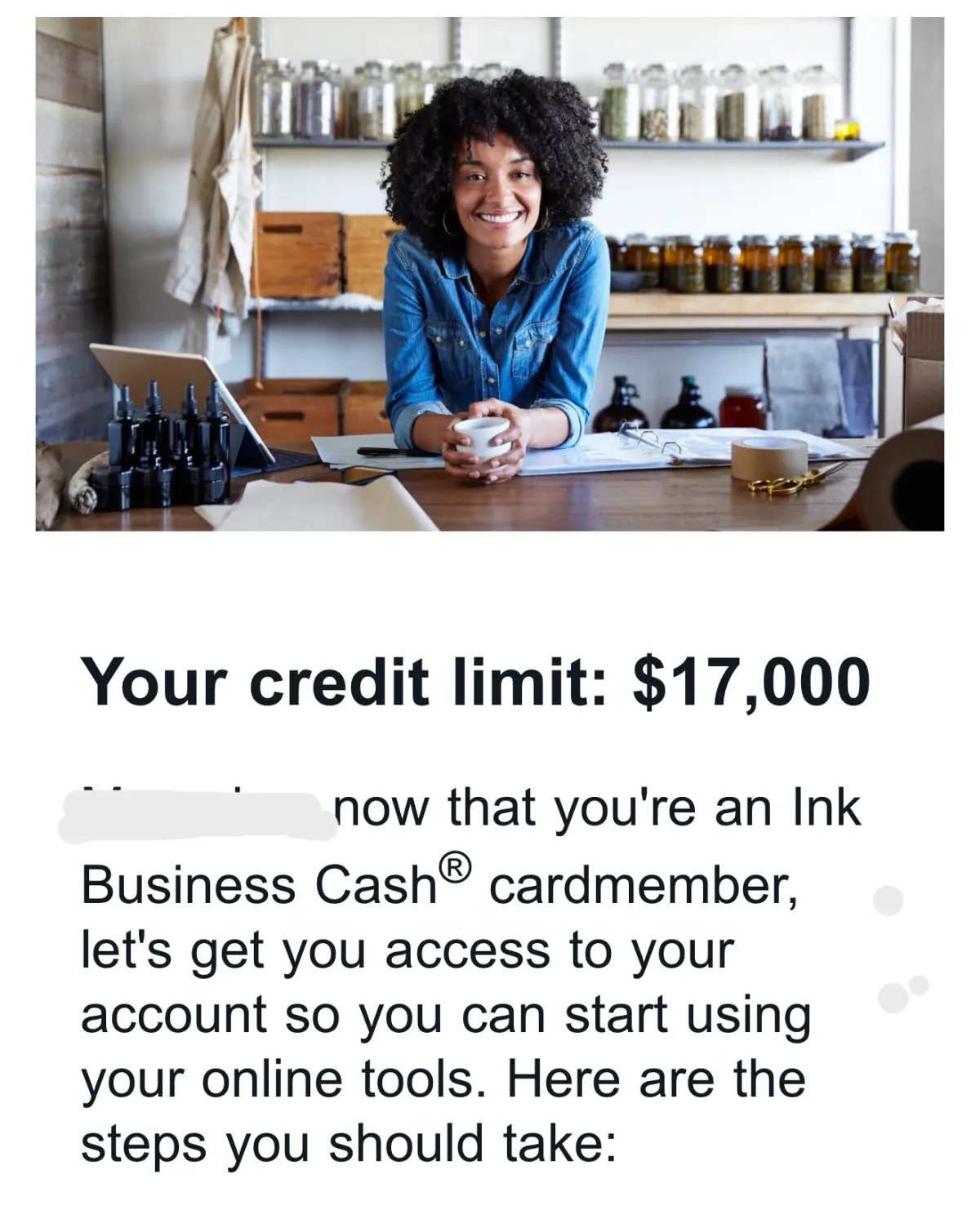

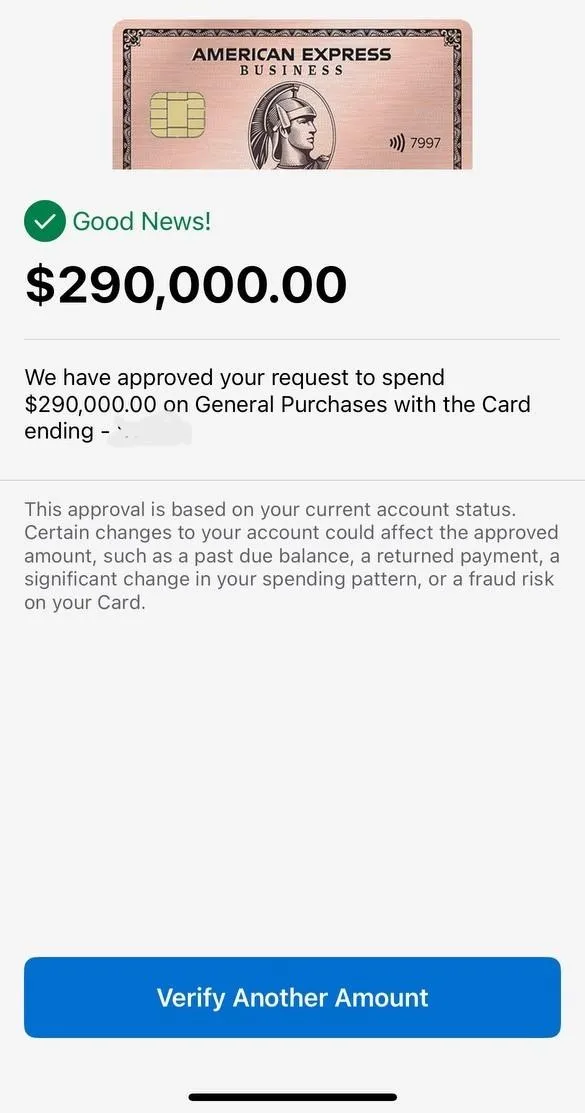

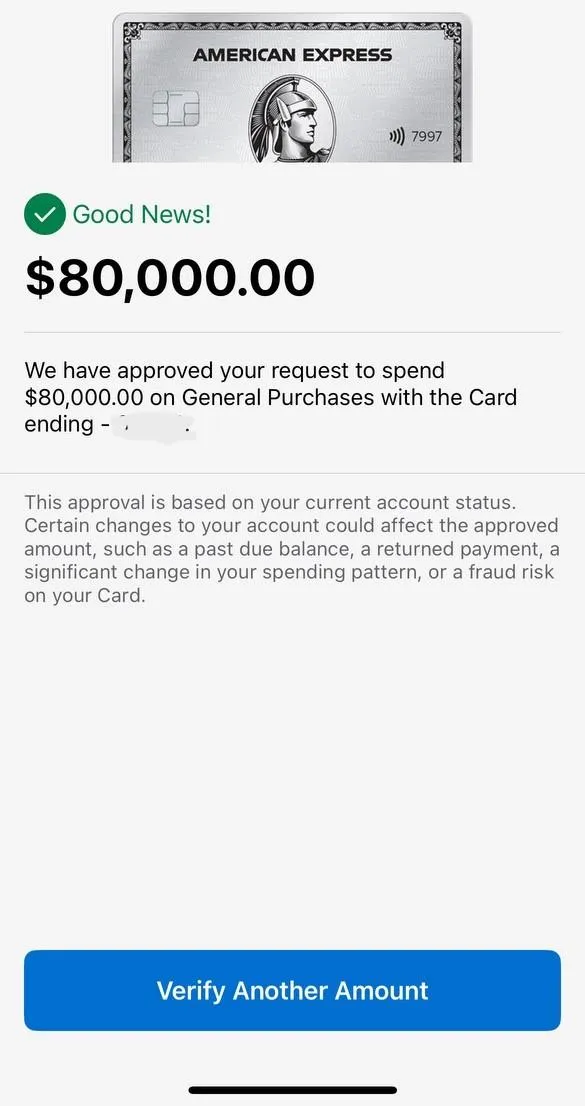

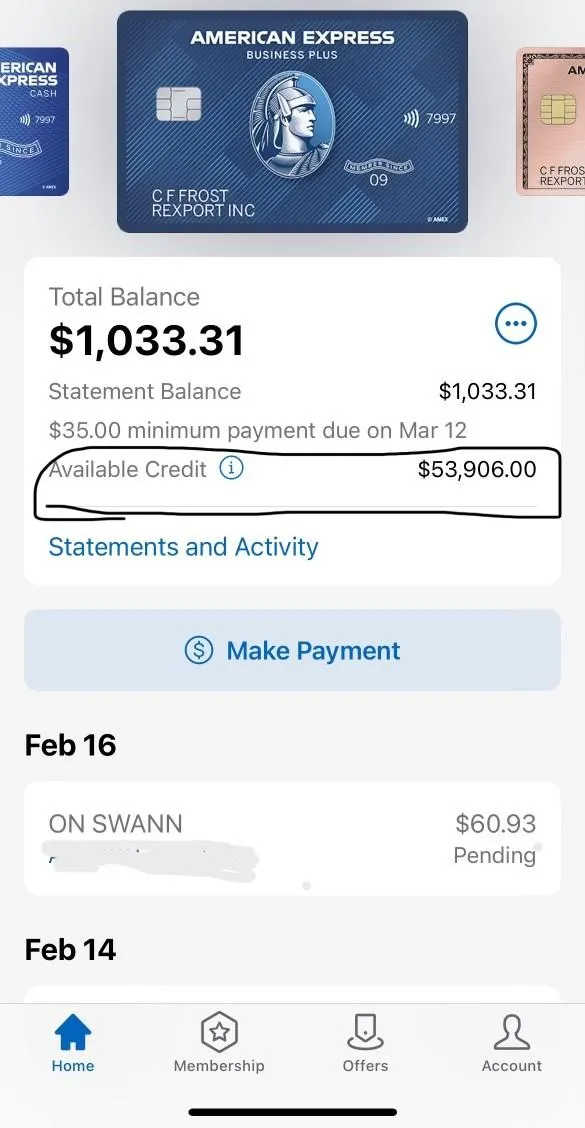

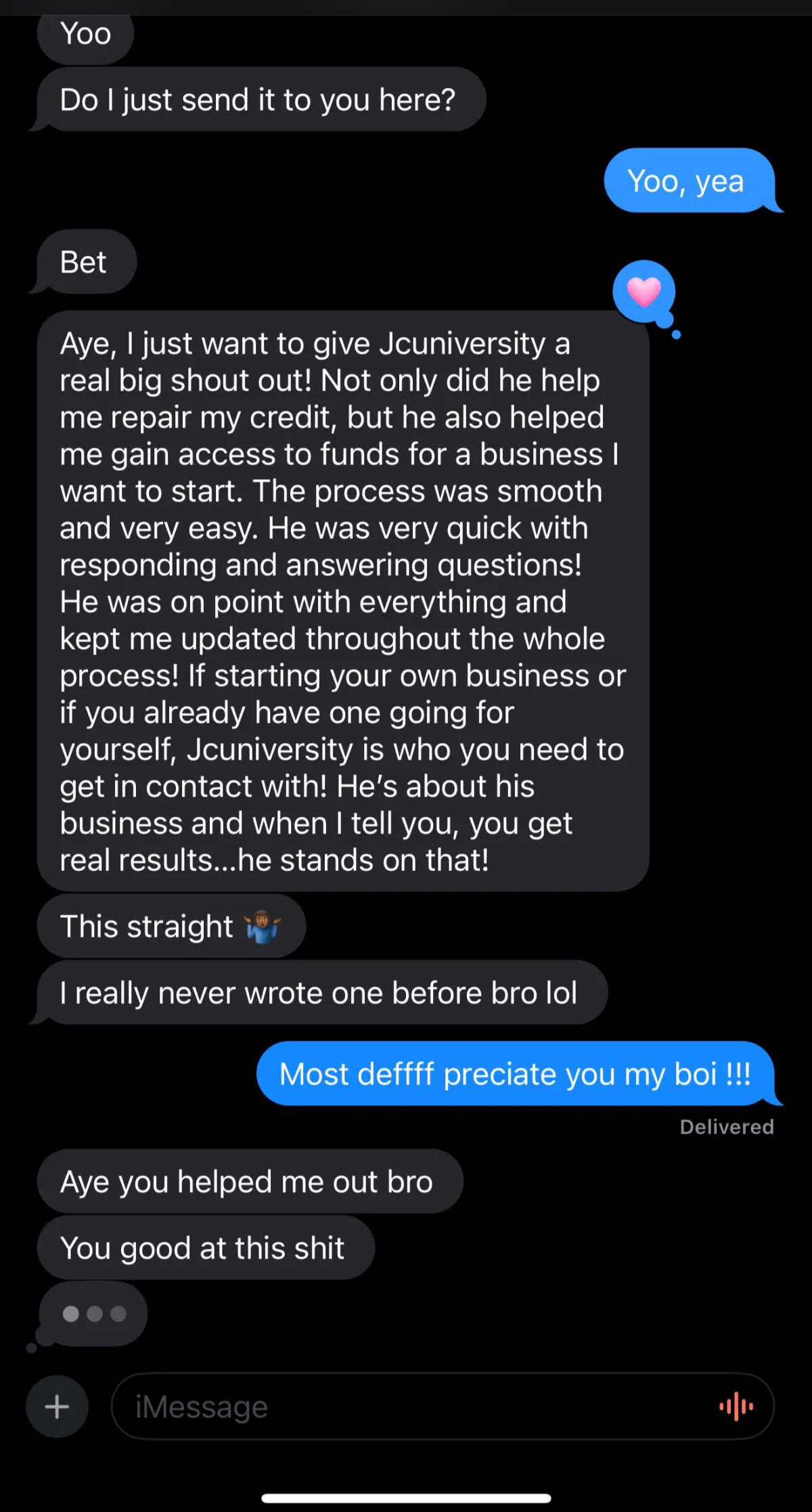

Get approvals using credit for funding

Launch or grow your business

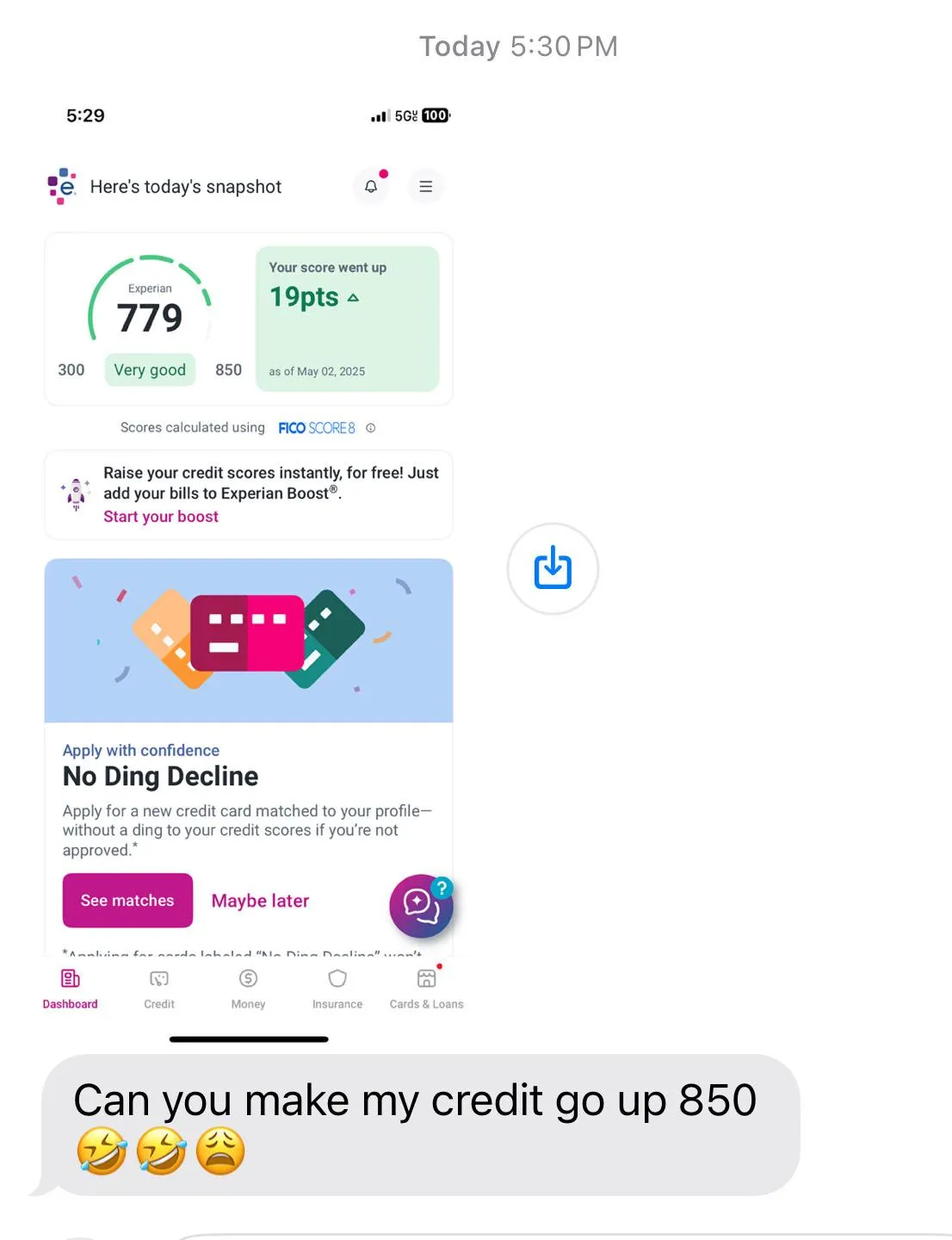

Fix your credit fast (680–750+ in weeks)

Access $50K–$250K in funding

Build real business credit along with personal

Learn how to leverage money the smart way

Gain access to lenders who actually say yes

Join a community focused on financial freedom

Results guaranteed — or your money back

Who this is NOT for

People who are comfortable with where they are

People not looking to grow

If you've already obtained over +100,000 in funding

If you never plan to buy a house

If you feel you dont want to make more money

If your satisfied where you are finanicially

If your not willing ot invest into yourself/Business

LETS GET STARTED

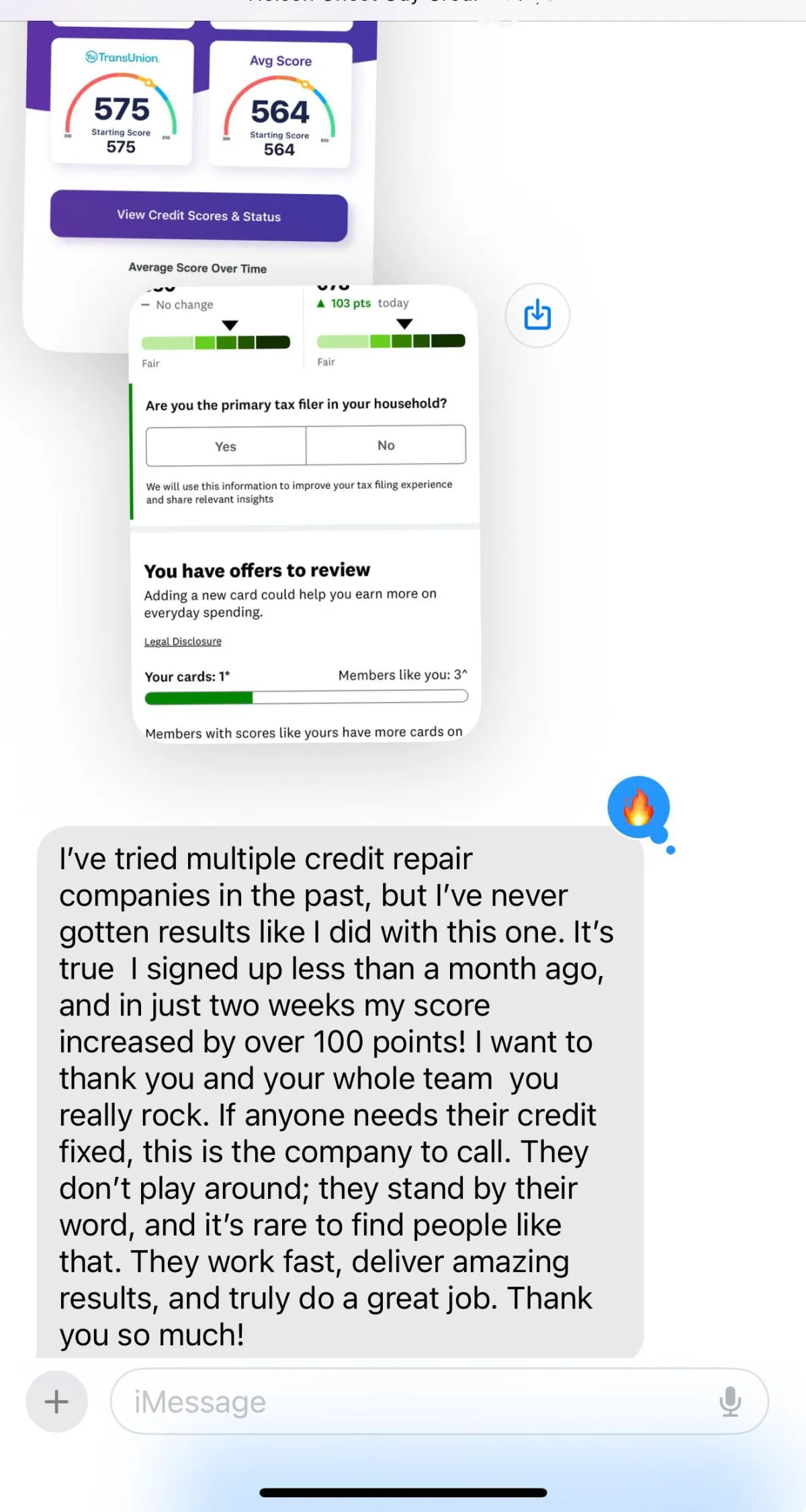

What our clients have to say

With JCU, Credit Gets Easy

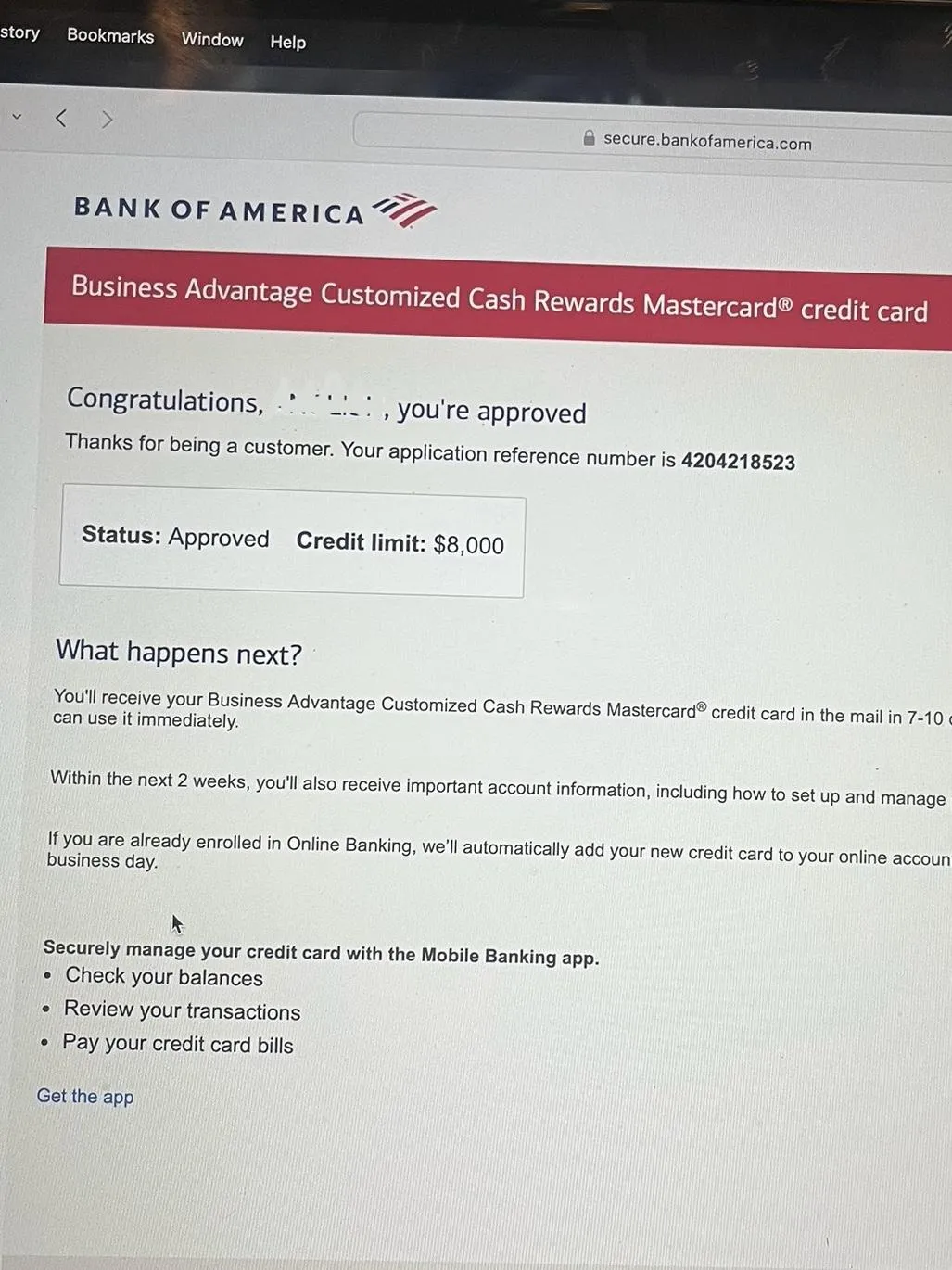

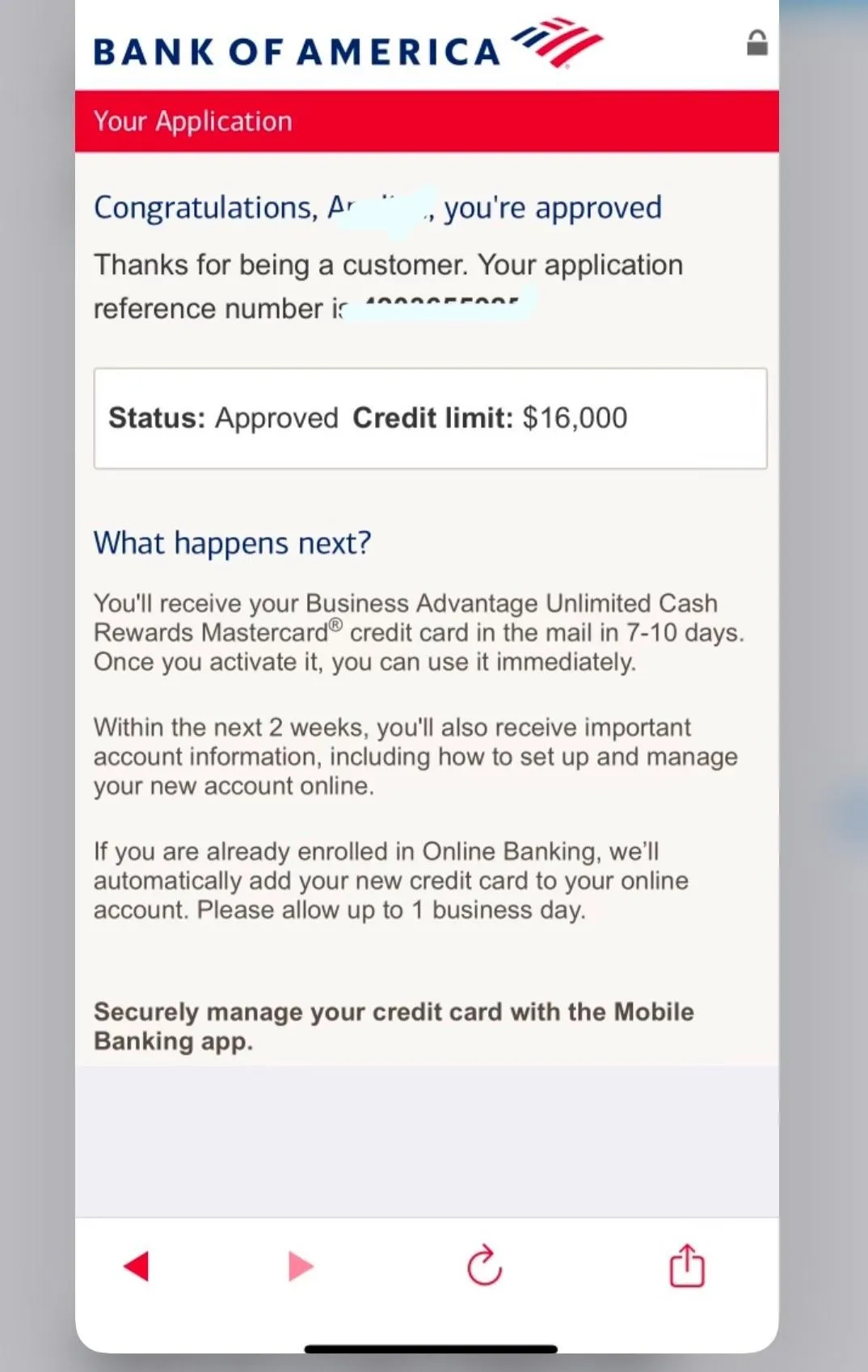

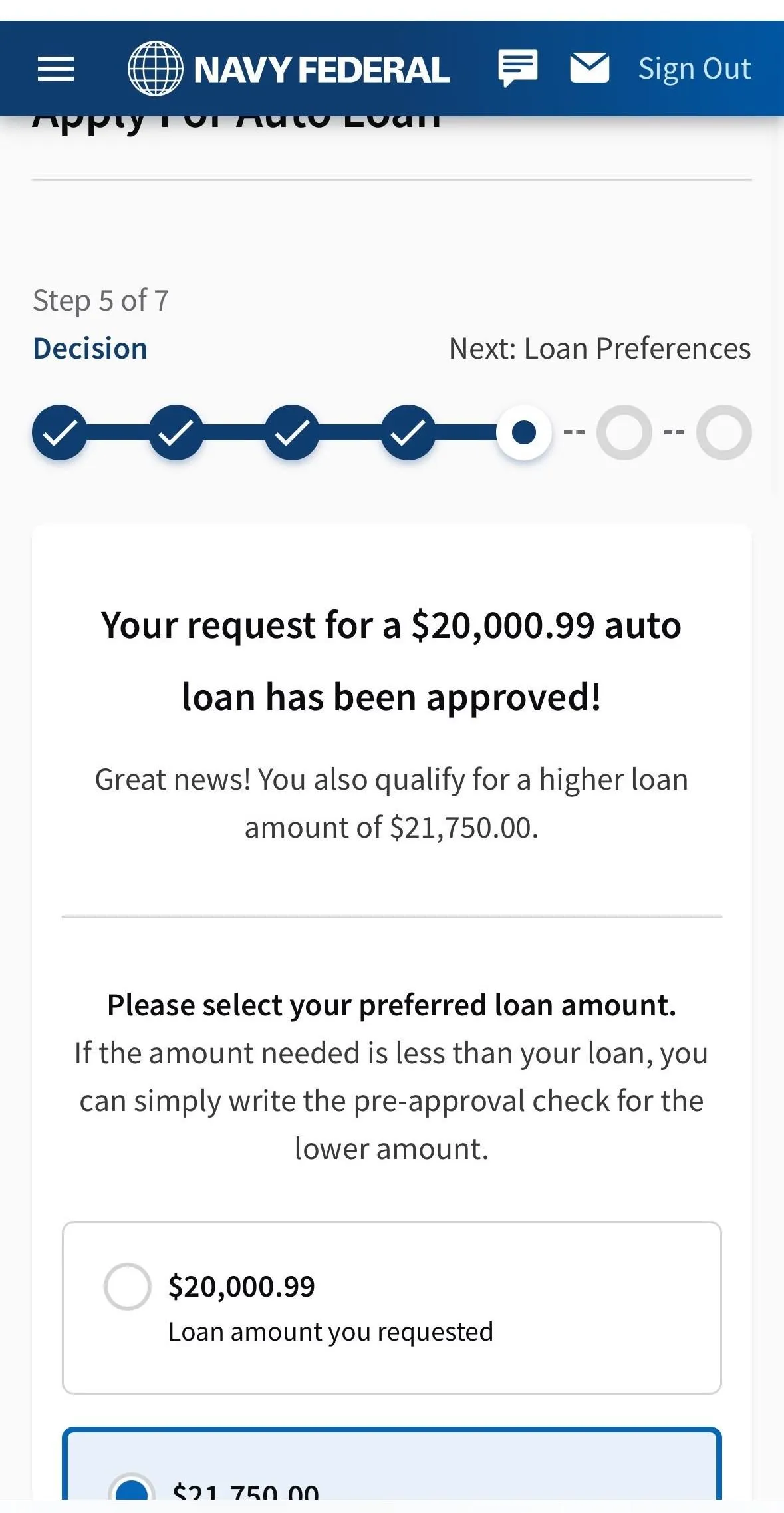

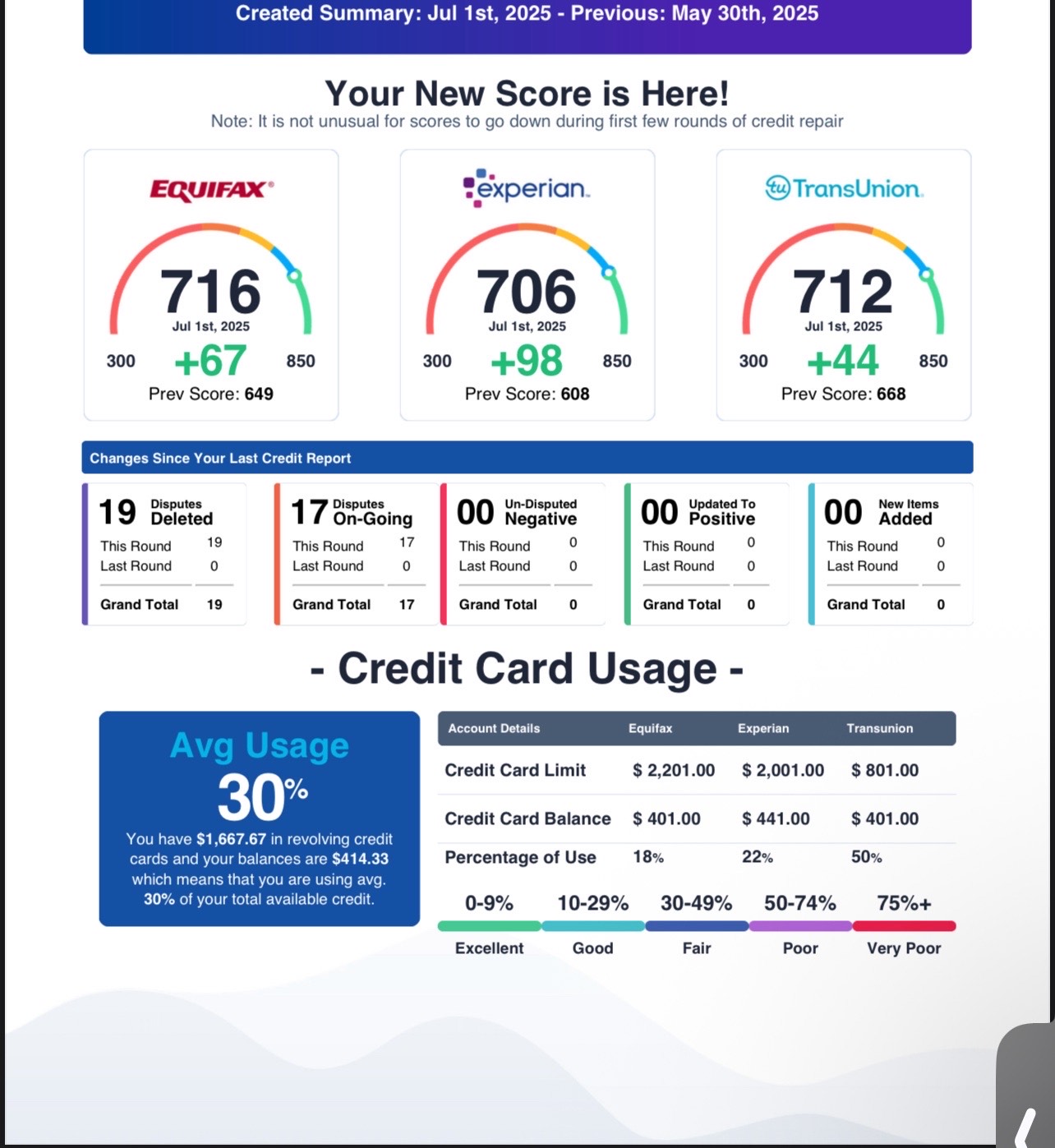

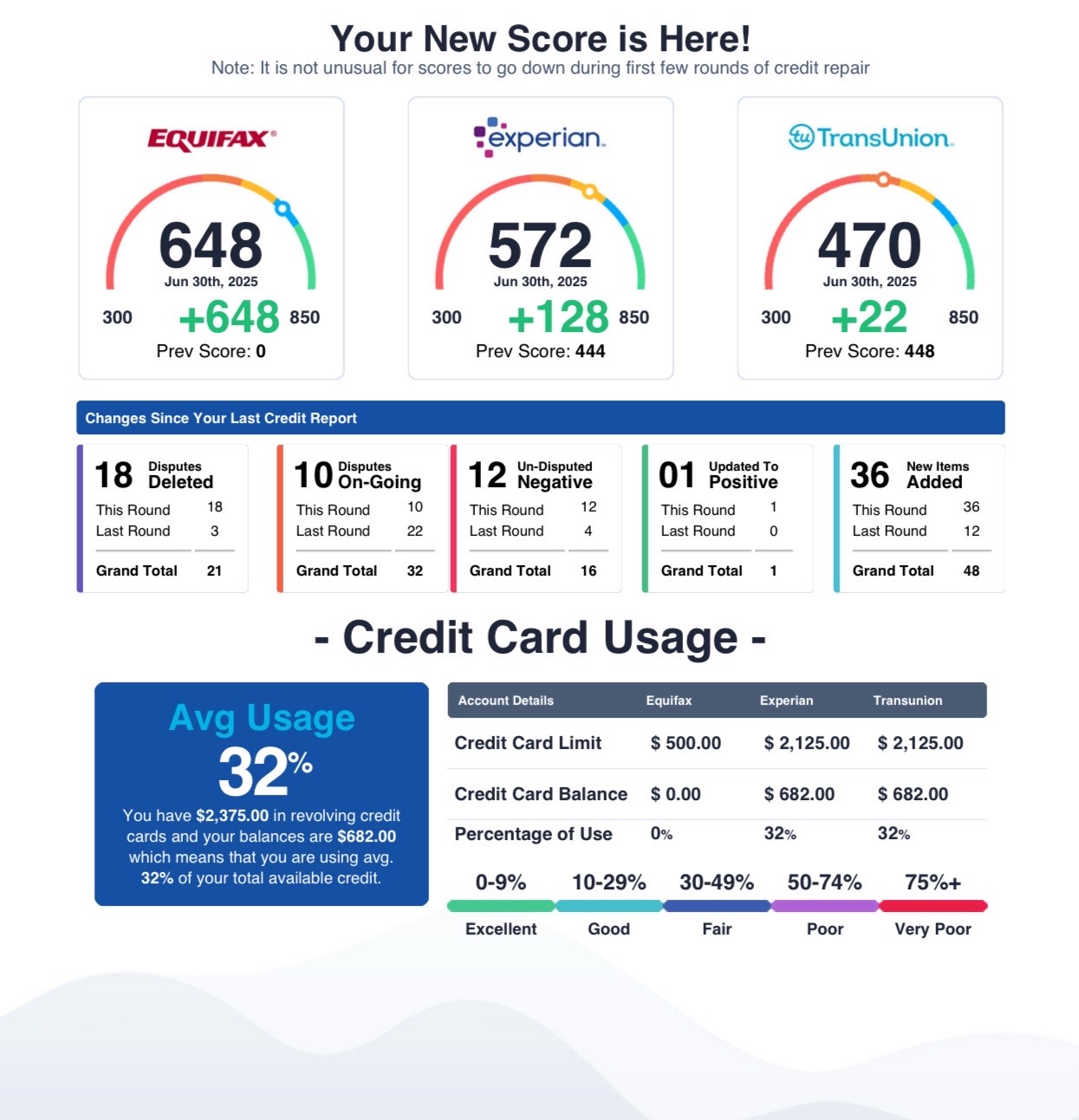

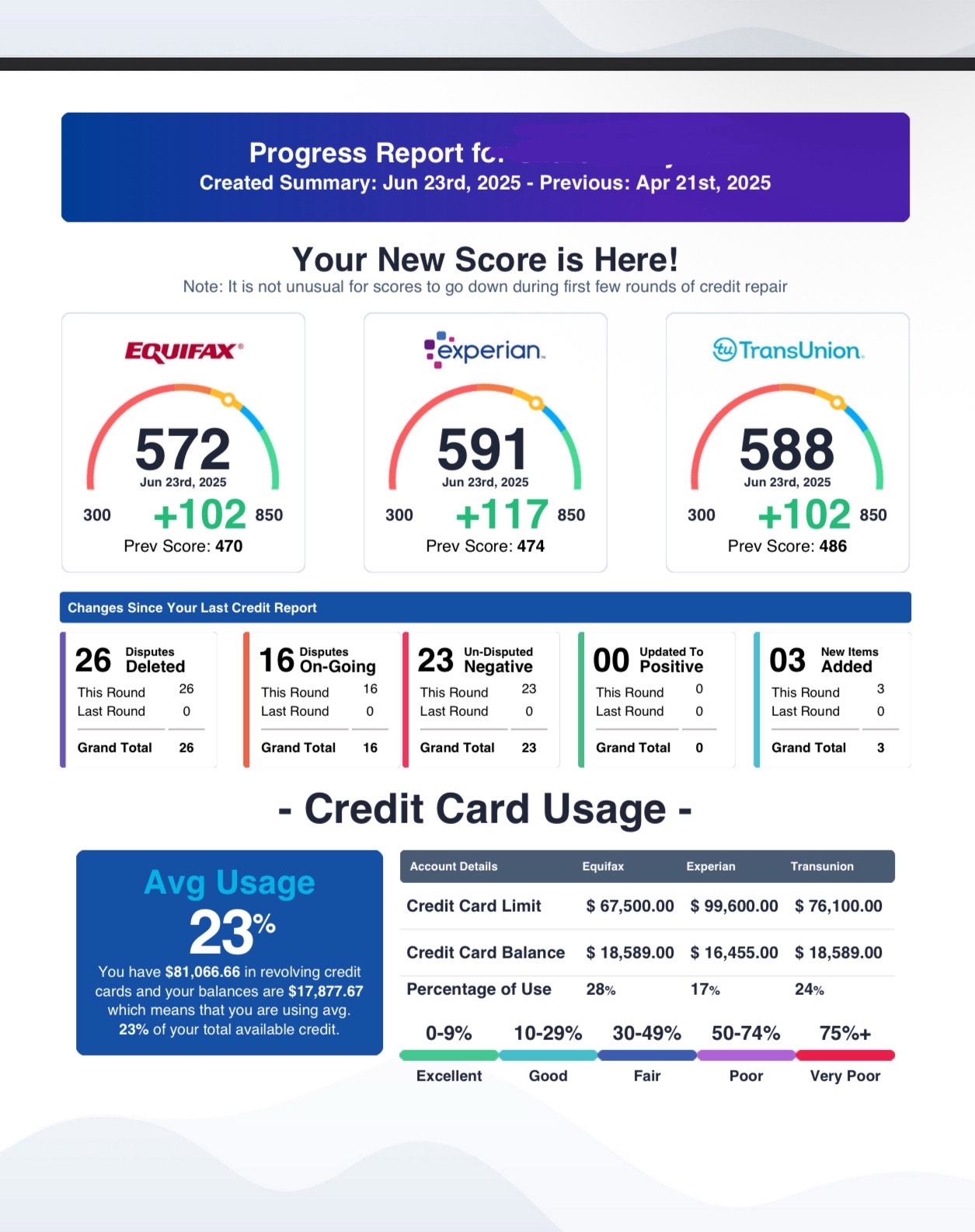

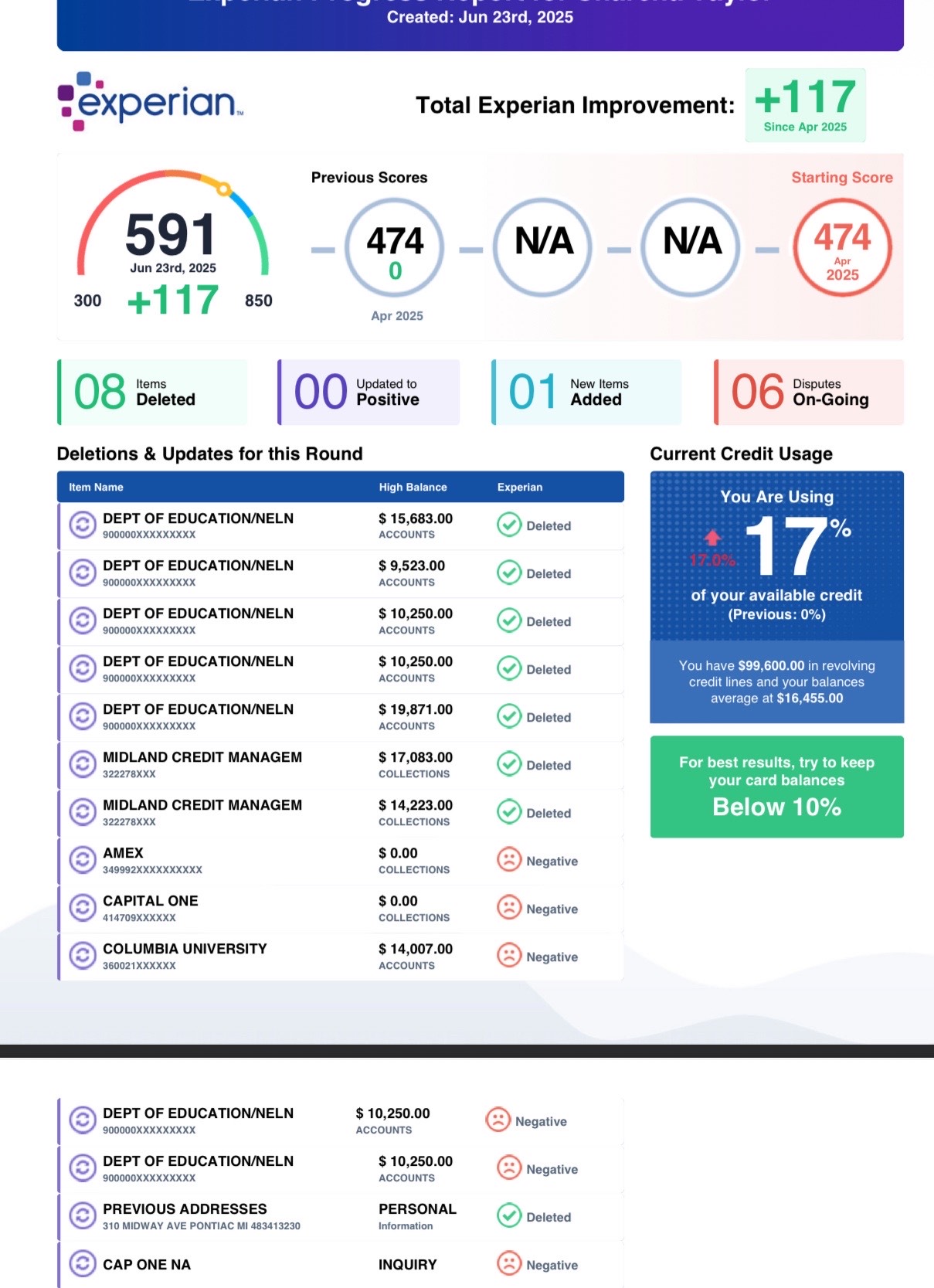

Here’s a glimpse of what it looks like to work with us

We do the hard part, so you don't have to

Results in just 30 days

BONUS

FREE 1-on-1 Set Up and Onboarding Call

List of top +50 banks to get approvals

Free Navy Federal hack to get Membership No hard pull

SECRET 10 lenders who offer you a credit limit with NO HARD PULL

Our Team Has Everything You Need To Clean and build your credit to a +700 plus.

Book a completely free call and get our credit roadmap

No funny bussiness - just free knowldge

GOT QUESTIONS?

Frequently Asked Questions

How do I know if JCU is right for me?

Let's find out! Book a demo with our team and they'll get to know you or your business, how it works, what you want us to do and then give you the honest answer! Click Here to Book a Demo from JCUniversity

Do you have tutorials and on-boarding?

Do you have tutorials and on-boarding? Oh boy do we! We have a comprehensive on-boarding process which makes setting up your JCUniversity account EASY - PLUS our support team are here to help you do whatever you want to do. Nothing is too big, too small or too complex for our experts!

Can I get extra help?

Of course! In fact, we recommend booking in proper Zoom Call sessions with the support team so you can share screens and even grant them access to your account to get in there and fix things. We're here to help in any way we can!

How soon can i expect results?

Most of our clients start seeing credit score improvements within 2–3 weeks, depending on their current situation and credit history.

From there, we continue working until all negative items are addressed and your profile is strong enough to qualify for funding.

Our process is fast, structured, and guaranteed — and we keep you updated with real progress reports every step of the way.

Got a question?

We've got answers! If you have more questions or need further assistance, don't hesitate to reach out at [email protected]